Last week’s biggest crypto news with a special bonus deal inside.

Bitcoin’s First $20,000 Breakthrough

December 12, 2022

Bitcoin’s First $20,000 Breakthrough

December 12, 2022

The First Time Bitcoin Reached $20,000 and How

The Bitcoin $20,000 run made many millionaires almost overnight and is remembered as the first time that cryptocurrency really went viral. In this article, we relive those heady days and dig deeper into what happened on the way to the Bitcoin 20,000 breakthrough in some of the most pinnacle moments in its price history.

The roots of the Bitcoin $20,000 bull run

Bitcoin’s $20,000 breakthrough had its roots at the end of the prior bear market. In November 2013, Bitcoin topped out at $1,242 and spent the following 13 months in freefall, with a capitulation event in January 2015 acting as the final flush before the new cycle began.

This flush saw Bitcoin’s price drop from $317 to $152 in just a few days, with mainstream media outlets attributing it to various outside influences, including a hack on the Bitstamp exchange a week before, “anticipation of the Feds selling 100K more bitcoins in light of the #SilkRoadTrial news” in the words of Roger Ver, Russia banning crypto websites, and finally, miners needing to settle their loans.

Whatever the reason, the capitulation put the stopper in the bear market and sparked nine months of accumulation before the price started to rise again and the bull market properly began.

The $1,000 mark was a key level

Nobody took much notice of Bitcoin’s recovery, particularly the media outlets that had predicted its demise – until it crossed $1,000 again. Bitcoin accomplished this 3 years after it had last been there when Bitcoin hit the $1,000 mark for the first time.

Bitcoin remained in this $1,000 pocket for 3 months, finally breaking out and trebling in value by the middle of 2017. The bull market was well and truly raging on, and it was clear that this time around something was different.

More and more first-timers were coming into the market, those who had previously had no interest in Bitcoin but were reading in the news about how it had gone 10x in six months and hearing from friends that now was the time to buy in, which is where the lead up to the Bitcoin 20,000 dollar breakthrough took flight.

Bitcoin fever really began to take hold in the second half of 2017. Popular cryptocurrency exchanges such as Coinbase began to see more Bitcoin purchases than they had ever experienced, as newcomers to the scene raced to pick up a stack.

There was no specific fundamental reason why Bitcoin was experiencing such rapid growth – it was still only accepted in a minority of online stores, and use in the physical world was still largely non-existent.

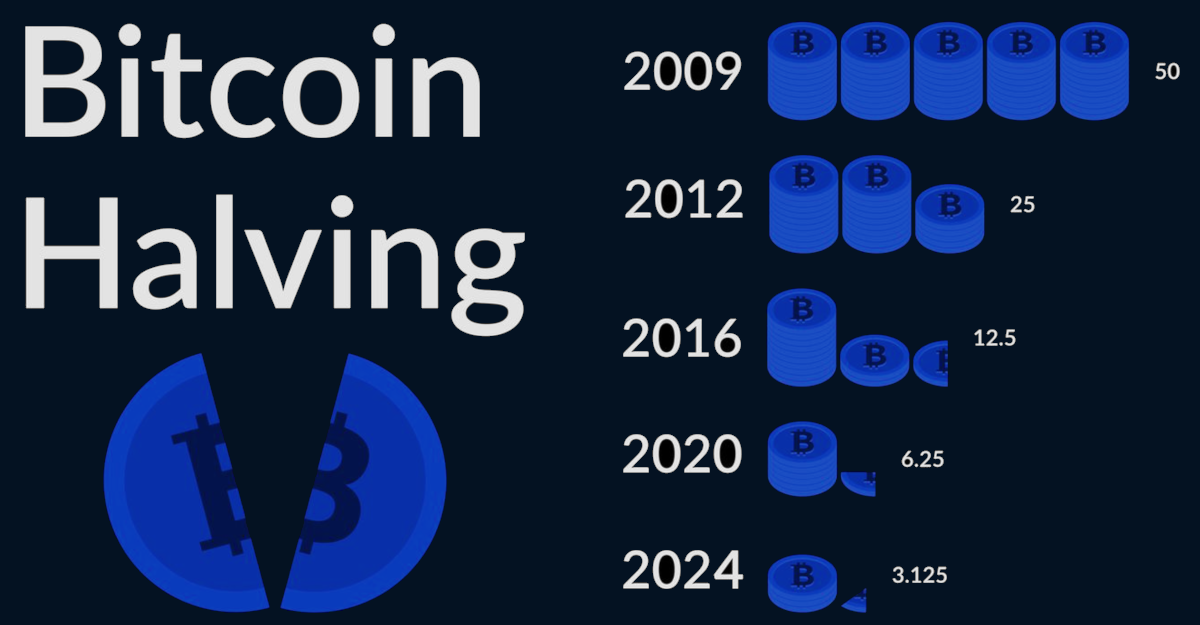

At the time, a Bitcoin $20,000 price was but a dream, but there were a few companies offering crypto debit cards which seemed to be promising, but this form of adoption was still in its infancy. As before, this bull run was cyclical, with the Bitcoin halving, which had occurred in July 2016, once again providing Bitcoin price history right in dictating a bull run.

The ‘Block Size War’

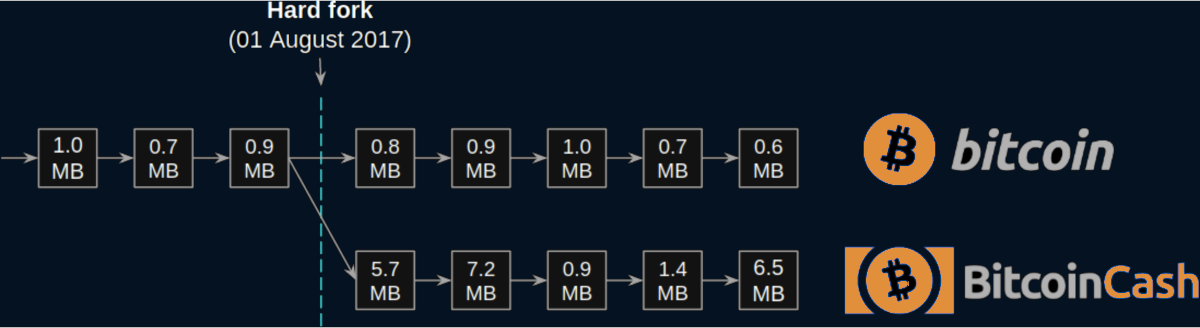

Despite all the positivity and price increases, there was one issue that threatened to tear Bitcoin apart in 2017 – the block size war. The war over Bitcoin’s block size had been brewing for years, but in 2017, the battle was in full swing. Within the Bitcoin world there were, broadly speaking, two camps – those who wanted Bitcoin’s block size to stay at 1MB, and those who wanted to expand it.

As Bitcoin had become more popular over the years, the blocks that formed Bitcoin’s blockchain were filling up with an increasing number of transactions. This caused transaction prices to increase and the network to become slower, as the only way to get a transaction through in a reasonable time was to pay a higher fee to miners for processing it.

There were various solid arguments on both sides of the block size debate, and a series of attempted compromises led to the New York Agreement in May 2017. This is where Bitcoin-related companies and miners decided to implement SegWit2x – a 2-stage amendment to Bitcoin’s protocol aimed at solving the scaling problem – at least enough to satisfy most moderates.

The birth of Bitcoin Cash

However, this wasn’t enough for some of the ‘big blockers’, who announced that they would launch a competing coin off the Bitcoin blockchain (called a ‘hard fork) if part 1 of SegWit2x was activated as planned in July.

This was a problem for Bitcoin because if the alternative, called Bitcoin Cash, proved more popular than the original, it could have led to this alternative coin becoming the official ‘Bitcoin’, and a Bitcoin $20,000 price never being reached.

When the New York Agreement was announced in May, Bitcoin’s price jumped 65% in nine days. However, the concerns over what might be about to happen with the hard fork caused the Bitcoin price to tumble 30% in the weeks leading up to August 1.

Fortunately, fears over what the hard fork might do were overblown, and when it finally happened, it became clear that the original Bitcoin was still the preferred coin by miners, and the worries were swept away.

As a result, Bitcoin’s price continued on its stratospheric journey, jumping 170% to $4,900 by early September, with the idea that it might double its block size in just a few weeks. But for a Bitcoin 20,000 price to be reached, there was still a lot that needed to happen.

Bitcoin fever hits… hard

By September 2017, Bitcoin fever struck hard. A whole new breed of buyers was emerging, buoyed by the sudden ease with which BTC could be acquired – it was easier than ever to buy bitcoin with a bank card, and the numbers showed. Buying volumes went through the roof on all exchanges, including the newly launched Binance, with those who knew nothing about Bitcoin simply joining in for the ride.

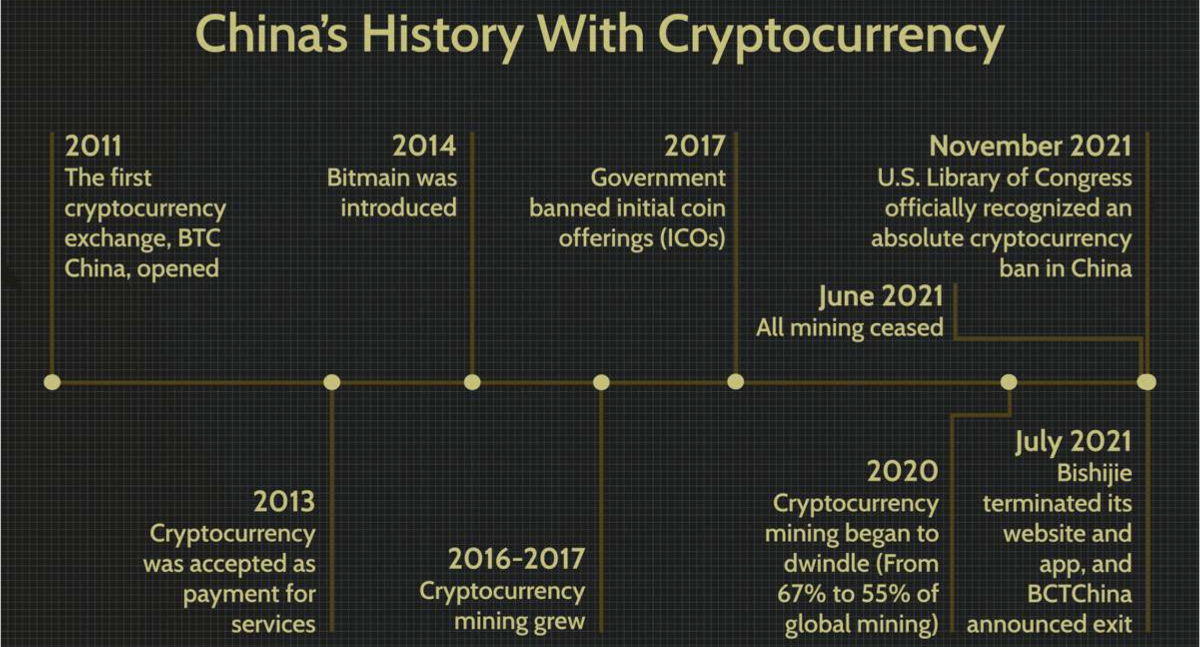

It wouldn’t be long however before a familiar foe would enter the fray and test holders’ strength – China. China had effectively ended the 2013 bull run by announcing that banks were not allowed to handle cash connected to crypto exchanges, severing a vital lifeline at a time when Bitcoin was heavily China-driven.

This time around, in mid-September, the Chinese government went one further – it was banning cryptocurrency exchanges from operating in the country altogether, and there was no hope for a Bitcoin $20,000 value.

Despite the Bitcoin market being much more heavily diversified in 2017 than it had been four years earlier, the market still reacted badly – Bitcoin’s price fell from $4,178 to $3,000.

However, the general direction of the market was too strong for this to have any kind of long-term impact, and many exchanges experienced their biggest weekly Bitcoin buying volume of all time as a direct result, propelling the price from $3,000 to $8,000 in less than two months as Bitcoin shrugged off concerns over China.

Bitcoin Cash takes the lead

The coin experienced one final moment of peril before its race to the Bitcoin $20,000 mark, brought on by the block size war once again. On November 8, the architects of the New York Agreement revealed that the 2x element of SegWit2x, the block size doubling, would not go ahead, citing a lack of support.

This led to a surge of support for the new Bitcoin Cash coin, which rocketed in price while Bitcoin dropped 29% within a few days.

However, this support didn’t last and it was realized that Bitcoin Cash had missed its chance to overtake Bitcoin. Bitcoin Cash’s price surge faded just 4 days after the announcement, and, with the block size wars now over, Bitcoin is prepared to take center stage once again.

Bitcoin futures fuels the fire

Having seen off the competition, it was now purely a case of how high Bitcoin could go. By now, you couldn’t budge with mainstream media outlets discussing its incredible rise, fueling a buying spree that saw exchanges having to limit the number of new registrations on a regular basis. Bitcoin breached $10,000 for the first time at the end of November, leading to one of the craziest months in Bitcoin history, and finally the Bitcoin 20,000 dollar price.

In early December, twin announcements from the Chicago Mercantile Exchange (CME) and the Chicago Board Options Exchange (CBOE) revealing that both had been given licenses to launch Bitcoin futures on their platforms led to one of the most explosive episodes in Bitcoin price history.

The price jumped from $11,600 to $16,500 in just 48 incredible hours. This presented the first institutional adoption of Bitcoin, and Bitcoin enthusiasts reveled in the news.

After a brief drop to $12,750, the coins rebounded and finally, we saw a Bitcoin $20,000 price value hitting the charts on December 17, 2017, marking an incredible run from just $800 the year before.

The mania was out of control, with predictions of $50,000 and even $100,000 doing the rounds. However, as it would turn out, this was to be the end of Bitcoin’s amazing run, with Bitcoin maxing out at $20,000 – for the time being, at least.

What stopped the runaway train?

There are several theories as to why the Bitcoin $20,000 run ended. One of the most compelling is that, contrary to the belief that the introduction of futures contracts by institutional players would help propel Bitcoin further, it actually acted to stop it in its tracks.

Futures markets allowed institutions with balance sheets bigger than Bitcoin’s entire market cap to short it (to place bets that it would go down) and use their influence to make sure it did. In fact, in 2019, Commodity Futures Trading Commission (CFTC) chairman at the time Christopher Giancarlo admitted as much in an interview:

“One of the untold stories of the past few years is that the CFTC, the Treasury, the SEC and the National Economic Council director at the time, Gary Cohn, believed that the launch of bitcoin futures would have the impact of popping the bitcoin bubble. And it worked.”

Bitcoin’s price history suggests that this is exactly what happened, and where Bitcoin would have gone had the U.S. authorities not gotten involved was a matter of much debate. Some who argue that it had been going parabolic for long enough and it was natural that it was going to come back down when it did.

Others, however, argued that with the number of people still waiting to buy in, it could well have kept going for some months more.

Of course, we’ll never know the answer to this question, but the Bitcoin $20,000 run in 2016-2017 will be remembered as the first time the general public got a foot in the door with Bitcoin – a love affair that has only grown stronger as the years have passed.

Jordan Huxley

Born on a blockchain with “HODL” as a middle name, the crypto-savvy Jordan Huxley guides our readers through the digital world of crypto with insightful guides and informative content, unveiling the power of crypto in his own, unique way. Get the latest updates on blockchain-related tech, advancements, news, and events with Jordan and our team of crypto gambling gurus on the Punt Casino Blog.